What Is a Last Will and Testament?

A last will and testament is a legal document that allows you to express your final wishes regarding the distribution of your assets, the care of any minor children, and the handling of your affairs after your death. It is a personal declaration that specifies who should inherit your property, who should assume guardianship of your children, if applicable, and who should execute your estate. Having a will is crucial for several reasons:

- It provides a straightforward path for distributing your assets and personal property, minimizing potential conflicts among family members.

- It also allows you to choose an executor responsible for managing your estate, ensuring that your wishes are carried out as intended.

- For those with minor children, a will is essential for naming guardians, ensuring that your children are cared for by the individuals you trust most.

The primary goal of a will is to ensure that your assets are distributed according to your wishes rather than being decided by state laws, which take over in the absence of a will. This document offers peace of mind, knowing that your intentions for your loved ones and legacy are clearly outlined.

Key Elements of a Last Will and Testament Legal Document

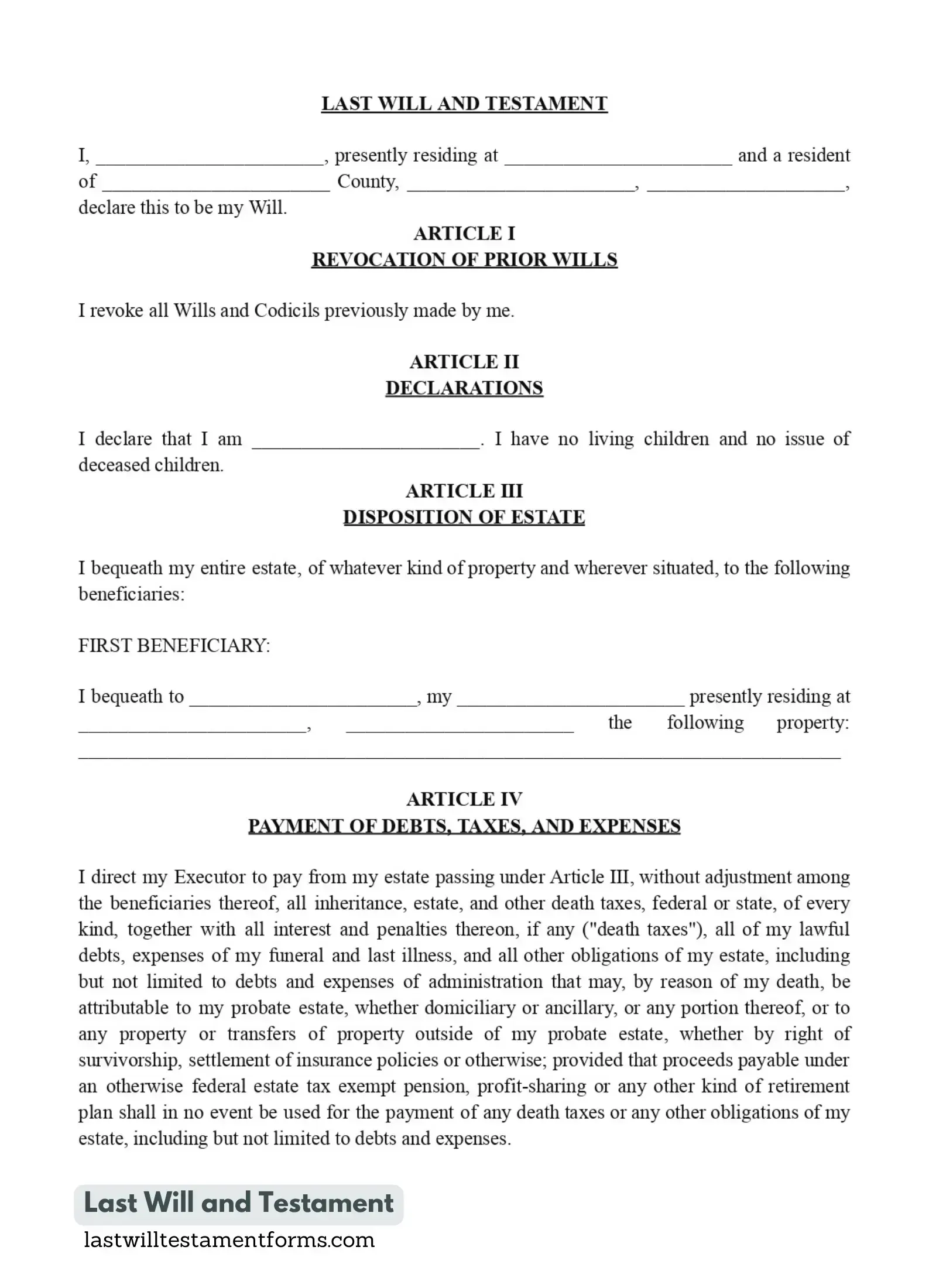

When preparing a last will and testament, several components must be included to ensure the legal document is effective and reflects your intentions. Here is a breakdown:

- Designation of an Executor. An executor is the person you appoint to manage your estate after your passing. This role includes paying off debts, managing estate finances, and ensuring that your assets are distributed according to the last will and testament.

- Identification of Beneficiaries. Designated beneficiaries are the persons or entities you choose to inherit your assets. You should name these parties to avoid any confusion or legal complications.

- Distribution of Assets and Property. This section details how you want your assets, including money, personal property, and personal belongings, to be distributed. It's essential to be specific to prevent misunderstandings or disputes among beneficiaries.

- Appointment of Guardians for Minor Children. If you have minor children, appoint a guardian in your last will and testament. This person will care for your children if you and the other parent cannot.

Each component is essential in ensuring that your will effectively communicates your wishes. Considering and specifying each element carefully can help you create a comprehensive will that serves as a clear guide for managing your estate and providing for your loved ones after your passing.

Requirements for a Legally Valid Will

Creating a last will and testament is a chance to clearly outline your intentions for your assets and the care of your family members. Such legal documents must meet specific criteria to be recognized as valid and enforceable.

1. Age and Mental Capacity

You must be at least 18 years old to create a last will and testament. This age requirement confirms that you can make such decisions legally.

You must be of sound mind when writing your will. It means understanding the document's purpose, being aware of your assets, and recognizing the people you wish to inherit them. This clarity ensures your will reflects your true intentions.

2. Writing Your Last Will and Testament

Your last will need to be written down. This can be typed, or, in some states, a handwritten (holographic) legal document is accepted. The written format makes your wishes clear and legally recognizable.

3. Signatures and Witnesses

Signing your will is a crucial action. It confirms that the document is yours and that you agree with its contents.

Typically, two disinterested witnesses are required. They must sign the will, verifying that they saw you sign it or acknowledge your signature. Choosing witnesses who are not beneficiaries can help avoid a conflict of interest.

While not mandatory everywhere, notarizing your will can add an extra layer of authenticity and may simplify the probate process later.

What Are the Types of Wills?

When considering the creation of a last will and testament, it's essential to understand the available types. Each serves a unique purpose and may be more suitable for different scenarios. It's advisable to consult with an estate planning attorney to determine which type best fits your circumstances and provides the most comprehensive protection for your assets.

1. Simple Will

A simple will is straightforward and typically used when your wishes are direct, and your estate isn't complicated. It outlines who inherits your property and may designate a guardian for minor children.

2. Testamentary Trust Will

This type of will sets up one or more trusts for part or all of your estate to benefit your beneficiaries. Testamentary trusts are helpful for managing assets for beneficiaries who are not ready to handle an inheritance directly, like minor children.

3. Joint Will

Two people, usually spouses, make a joint will in a single document. They agree that when one dies, the other inherits everything, and then the estate passes to the agreed beneficiaries when the second person dies. Today, joint wills are essential estate planning tools.

4. Holographic Will

This is a handwritten will. Such estate planning documents are not witnessed but must be entirely in the handwriting of the person making the will. Holographic wills are not recognized in all states and can be more susceptible to challenges.

5. Living Will

Not to be confused with last wills and testaments, a living will is a document that sets out your wishes for medical care if you cannot communicate them yourself. A living will is often accompanied by a healthcare power of attorney, which designates someone to make medical decisions on your behalf.

Last Will and Testament: Explanation of the Probate Process

The probate process is critical to executing a last will and testament. It's the legal procedure through which a deceased person's will is validated, and their estate is administered. Understanding how probate court works is essential for anyone writing a last will and testament, as it affects how and when your assets will be distributed to your beneficiaries.

Probate is a court-supervised process that starts with validating a deceased person's will. It involves several key activities. The last will is initially filed with the probate court, usually by the executor named in the document. The probate court then reviews the last will and testament to ensure it's legally sound and authentic.

Once the will is validated, the executor is formally appointed to manage the estate. This role includes identifying and cataloging the deceased's assets. The executor is also responsible for settling outstanding debts and taxes using the estate's resources. Finally, after all debts and estate taxes have been paid, the executor distributes the remaining assets to the beneficiaries according to the instructions in the will.

How Is a Will Executed with the Probate Court?

The execution of a last will and testament with probate court is a systematic process that ensures the deceased's wishes are honored:

- Validation of the Last Will. The first step is validating the will. The court examines the document to confirm it was created in compliance with state laws.

- Executor in Action. Once the will is deemed valid, the executor takes charge. Their role is to manage the estate following the will's directives.

- Meeting Obligations. The executor is responsible for paying any outstanding debts or taxes the estate owes. It is a crucial step to ensure all legal obligations are met before the distribution of assets.

- Distribution to Beneficiaries. After all debts and taxes are cleared, the executor distributes the remaining assets. This is done strictly according to the will's stipulations, ensuring that each beneficiary receives what the deceased intended.

Probate can be lengthy and sometimes complex, often taking months or even years to complete, depending on the estate's complexity. The thorough nature of probate ensures that the deceased's wishes, as outlined in their will, are followed precisely and legally.

What Assets in a Will Are Subject to Probate?

When dealing with this legal process, it's crucial to understand which assets are subject to probate and which are not. It can be complex, but a clear understanding of these categories simplifies executing a last will and entire estate management. Probate assets are those owned solely by the deceased or in joint tenancy without the right of survivorship. It includes sole real estate ownership, personal property, financial accounts, investments and stocks, and business interests.

Certain assets are designed to bypass probate court, often because they have beneficiary designations or are structured to transfer ownership automatically upon death. These include:

- Jointly Owned Property. Property owned jointly, often by spouses, that automatically passes to the surviving owner.

- POD or TOD Accounts. These include bank accounts or investment accounts with designated beneficiaries.

- Life Insurance Policies. Proceeds from the life insurance policy go directly to the named beneficiaries and are not subject to probate.

- Retirement Accounts. IRAs, 401(k)s, and other retirement accounts typically have designated beneficiaries.

- Trusts. Assets held in a living trust are distributed according to its terms without going through probate.

It's always advisable to consult an estate lawyer or law firm to make the most informed decisions regarding your assets and estate plan.

When and Why Should You Update a Last Will?

Updating your last will and testament is a significant task that ensures your document stays relevant and reflects your current wishes. Life changes, so your last will should evolve to accommodate these shifts to make a valid will.

1. Major Life Event

Life events like marriage, divorce, birth of a child, adoption, or the death of a family member can significantly alter your relationships and, consequently, your estate planning needs.

2. Financial Changes

Significant changes in your financial situation (acquiring or losing substantial estate assets, starting a business, or receiving a large inheritance) may require adjustments in your last will and estate plan.

3. Relocation

Due to different estate laws, moving to a different state or country can necessitate an update. Sometimes, you may even have to revise your estate plan entirely.

4. Change in Wishes

Over time, your preferences about how you wish to distribute your assets or who you want to appoint as guardians for your children might change. So, you must update your last will and testament.

4. Changes in Laws

Estate laws can change, impacting how your assets might be distributed or taxed. In such cases, you must update your last will and testament according to the state law.

The Bottom Line

In summary, creating a last will and testament is fundamental in managing your estate and ensuring your wishes are respected after your passing. A valid will is a clear declaration of your intentions, offering you and your loved ones peace of mind.

Once your last will and testament is created or updated, it's crucial to store it safely. Keep it secure, such as a fireproof safe deposit box, and ensure your executor and close family members know where and how to access it. This ensures that your will can be found quickly and acted upon immediately when the time comes.

Related Posts

Follow these links to meticulously write and safeguard your last will, ensuring it precisely reflects your wishes and secures your assets for your beneficiaries:

- Key Components of a Last Will and Testament

- Importance of Having a Last Will

- Addressing Digital Assets in Your Last Will

- Common Mistakes to Avoid in Drafting a Will

- State Laws and Their Impact on Your Last Will

- Difference Between a Will and a Living Trust

- Revocable vs. Irrevocable Trust: What You Need to Know

- How to Set Up a Living Trust

- What Is the Difference Between an Executor and a Trustee?

- What Is an Estate Attorney and What Do They Do?

- Types of Last Wills

- What is a Simple Will?

- What is a Testamentary Trust Will?

- Legal Requirements for a Will to Be Valid

- Signing Requirements to Make Your Will Valid

- State-Specific Witness Requirements for a Last Will

- Holographic Wills: Definition and Requirements

- How to Write a Last Will

- What Assets Should You Include in Your Will?

- How to Designate Beneficiaries in a Will

- How to Appoint a Guardian for Minor Children in a Will

- Guardian's Responsibilities and Duties

- Can You Place Restrictions and Conditions on Inheritance

- Creating Trusts for Beneficiaries with Special Needs

- Selecting the Executor for Your Last Will

- What Is the Executor of a Will?

- How Much Does the Executor of a Will Get Paid?

- What Are the Types of Bequests in a Will?

- What Are Residuary Bequests and How to Distribute Them?

- What Are Contingent Bequests and How to Distribute Them?

- How to Protect Your Last Will

- What Is Probate and How Does It Work?

- What You Should Know About Real Estate Valuation

- How and When to Contest a Last Will

- How to and Why Update a Will

- Common Changes to Wills